Air Transport 2035: Four Possible Post-COVID-19 Scenarios for Aviation

Share

APEX Media takes a look at the findings of the first part of the research conducted by Fast Future and Future Travel Experience, COVID-19 Air Transport Near Term Impacts and Scenarios.

The first installment of Air Transport 2035, a four-part research study conducted by Fast Future, Future Travel Experience and APEX, has identified four potential scenarios with regards to how COVID-19 will affect commercial aviation over the next two years.

The research study consisted of a 16-question survey completed by 269 industry professionals from 47 countries, alongside research and expert interviews. The participants of a subsequent webinar, which drew over 900 participants, were also polled on some of the questions.

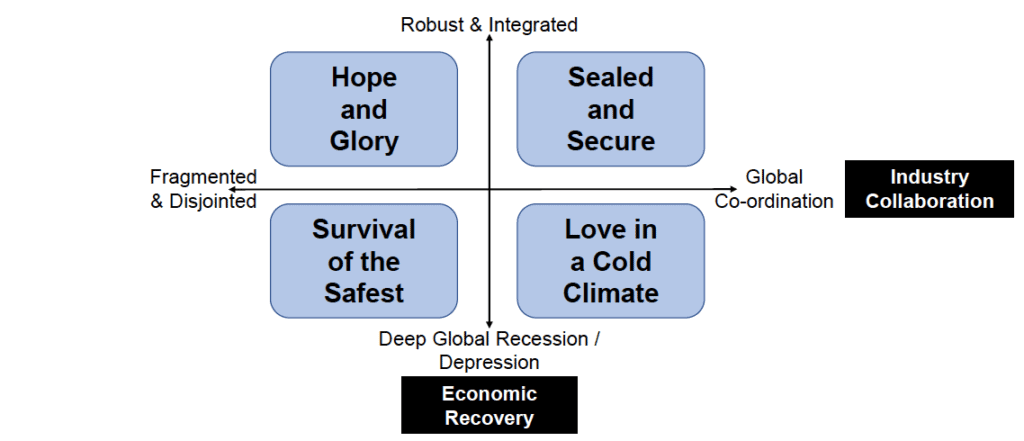

Initial results identified that the recovery of commercial aviation is dependent on numerous factors, but using what Fast Future CEO Rohit Talwar refers to as “the driving force model of scenario development,” the research team created a matrix based on two key axes: Economic recovery and industry collaboration. This matrix is the basis of the study’s four scenarios.

The first, “Survival of the Safest,” sees a deep recession and fragmented industry response. In this scenario, the report suggests passengers’ reluctance to fly would be heightened by confusing protocols differing by country, airline and airport. “That’s the scenario where you could see a lot of airlines folding and airports having to close, because we just don’t have the recovery of passenger numbers,” explained Talwar during Inmarsat’s FlightPlan online broadcast event. “Those that do survive will be the ones who can demonstrate the strongest end-to-end safety methods.”

The second scenario, “Love in a Cold Climate,” predicts what air travel could look like if there is an economic recession, but a co-ordinated industry response. While financial hardship would mean less leisure travelers, the report argues that business travelers and those with disposable income would be more likely to feel safe when flying, spurring a growth in demand.

Meanwhile, “Hope and Glory” imagines strong economic recovery, but a fragmented industry response. In this scenario, the study predicts that the air transport ecosystem will rely on passengers to take responsibility for testing, vaccination, and certification, meaning that air travel demand would return, but revenue would lag due to intense competition.

“Those that do survive will be the ones who can demonstrate the strongest end-to-end safety methods.” – Rohit Talwar, Fast Future

The fourth scenario, “Sealed and Secure,” imagines economic recovery alongside a cross-sectoral approach. “This is a scenario where the industry is basically hermetically sealing the travel experience,” Talwar said. This scenario has interesting implications for the passenger experience. During FlightPlan, he elaborated, “You could see that from the point where a traveler makes their booking, they have either an antibody test to demonstrate that they’ve had the virus or (later down the road) that they’ve had the vaccination, but before they get to the airport they’ve already got a certificate to prove that.”

“Within the airport, you might end up seeing three different zones and that experience would be carried all the way through,” Talwar continued. “Everyone you come in contact with through that experience would have the same certification, so there are almost zero risks for you. Mirrored on the plane, we may well start to see three different types of cabin mirroring those categories of antibody, antigen or vaccine certification, and then finally the same process the other end.” Ideally, Talwar concluded, this model could carry on when switching between airlines and airports.

However, few webinar participants (18%) predict that a “Sealed and Secure” scenario is most likely. Instead, the highest number of respondents (32%) predict a “Survival of the Safest” scenario, followed by “Love in a Cold Climate” (30%) – both of which foresee a financial recession or depression. Only 20% of respondents foresee the scenario outlined in “Hope and Glory.”

Whatever happens, the majority of webinar respondents agreed on what measures need to be taken to win passengers back. 39.7% voted “Safety kits including hand sanitizer bottles, wipes and masks for all passengers” as the solution that would get the most passengers flying again sooner, followed by 30% for “Continuous ticket flexibility without penalty.”

Indeed, despite their gloomy predictions about economic and global recovery, it appears the industry is still looking to improve customer experience and service, with 48.5% of initial survey respondents (not webinar participants) expecting to see an increase in spending in this area over the next two years. While the passenger experience may change, it appears industry stakeholders are keen to change it for the better, despite the extenuating circumstances created by COVID-19.

The COVID-19 Air Transport Near Term Impacts and Scenarios report can now be downloaded via the Fast Future website.