How China’s Aviation Industry Is Recovering From COVID-19

Share

APEX and CAPA are working together to share knowledge that will help the global aviation industry recover as quickly as possible during this unprecedented time. Tune in to CAPA LIVE Summit each month for a segment from APEX and keep an eye out for CAPA’s monthly column on APEX’s news website.

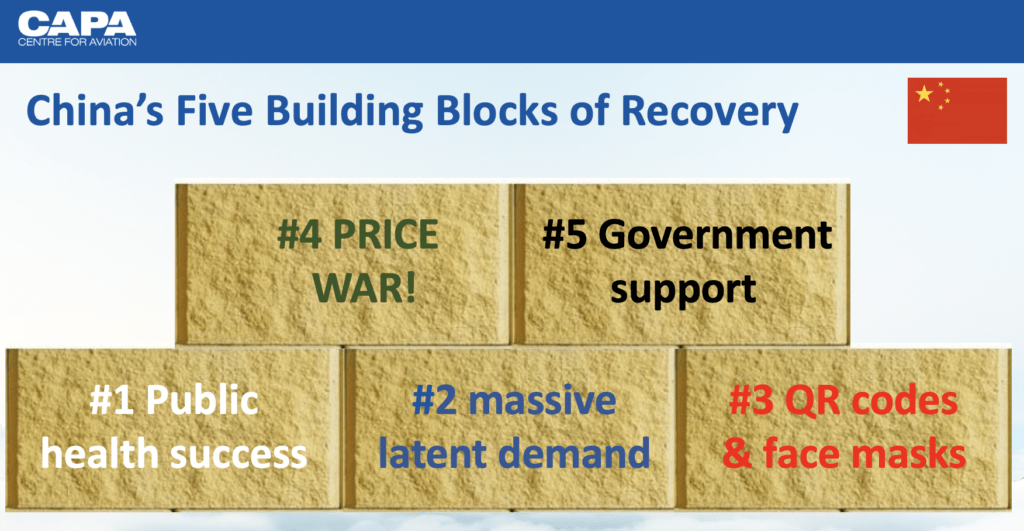

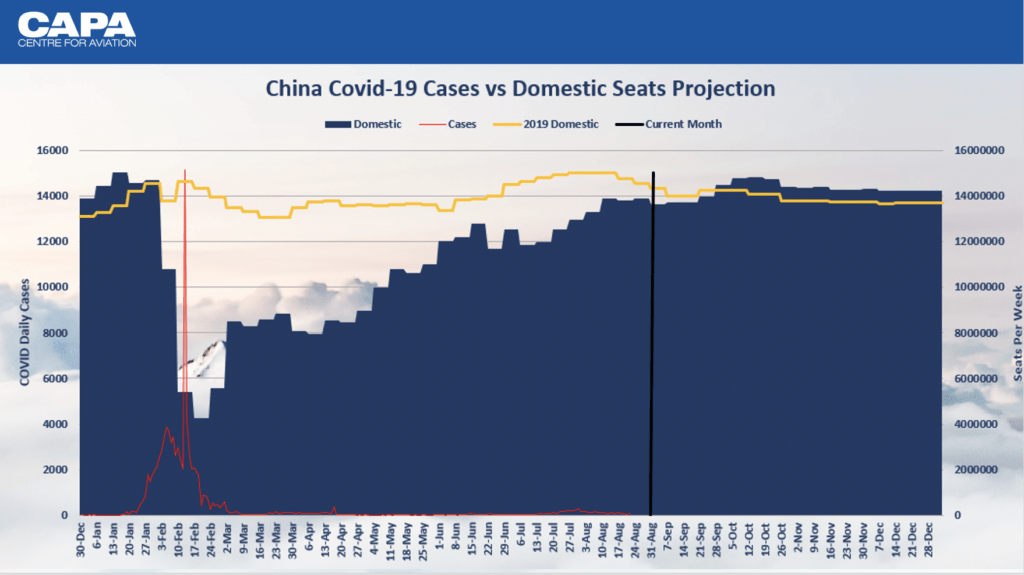

The world’s aviation and travel industry has been decimated by COVID-19. But one country has staged a remarkable recovery. Across China, aircraft are full, hotels and attractions are bustling, and much-needed travel revenues are flowing again. China’s domestic aviation industry is now very close to 2019 levels and will likely enter positive territory year-on-year before the end of 2020. CAPA has translated the resurgence of China’s aviation industry to five building blocks of recovery.

Public Health Success

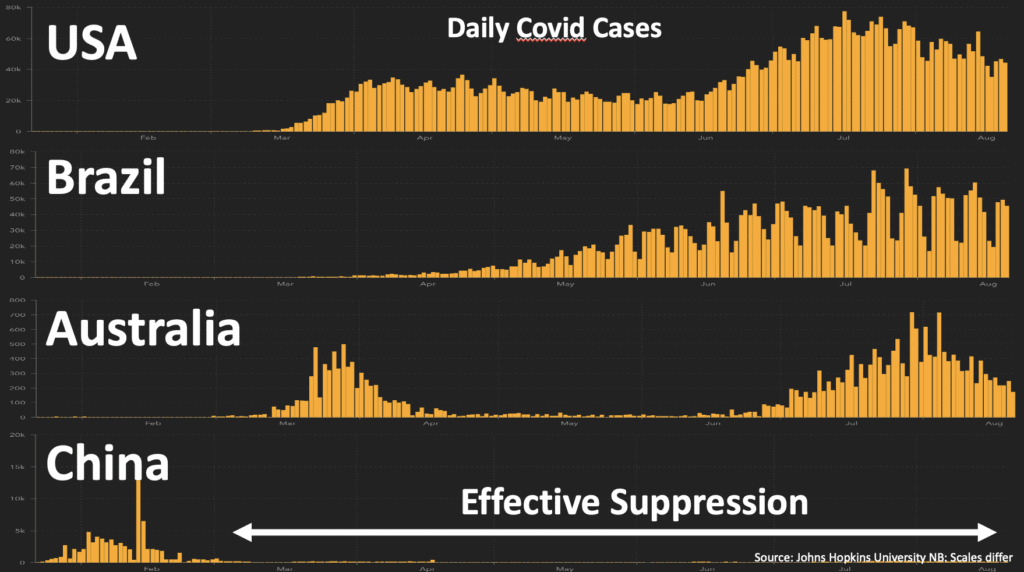

The USA has the world’s highest number of infections and saw a huge spike after the Memorial Day weekend in May. Brazil too has seen surging infections despite several months’ delay in the initial onset. Australia has seen a large spike in Melbourne and surrounding areas following the failure of hotel quarantine arrangements for travellers arriving from overseas.

In contrast, China, the original epicentre of the outbreak, had success in containing the initial Wuhan outbreak and has effectively suppressed flare-ups in Beijing and other provinces ever since through effective prevention works led by local governments. Massive rates of COVID PCR testing and quarantines for Chinese travellers who have visited a high-risk region in the prior 14 days have been crucial to maintaining China’s low rates of infection.

But like every other country that has done a good initial job of containing and suppressing COVID-19, like New Zealand and Vietnam, China’s recovery should be viewed as fragile and not without risk.

Massive Latent Demand

The second building block of China’s resurgent travel market is its massive latent demand. China has leapfrogged the USA to become the world’s largest aviation market.

The outbreak struck China just before the annual Lunar New Year holiday season in late January, disrupting the travel plans of millions. Holidays were delayed and Chinese travellers helped spawn a new post-lockdown trend: revenge travel. The term is borrowed from the concept of “revenge spending” which emerged in China in the 1980s in response to years of repressed demand caused by the Cultural Revolution.

Continuing low infection rates gave Chinese travellers confidence to dream about travelling again. On Tomb Sweeping Day in April 60% of people who booked trips were aged 30 years or younger, which was a big increase from the 43% share a year earlier.

Technology Inspires Confidence

Thirdly, there was a key piece of new technology (QR codes) and some old technology (face masks) that encouraged travellers to fly. Mask wearing in China – and most of Asia – has been commonplace for decades. It’s viewed as a common courtesy to protect others in the community.

China has also rolled out QR code technology on people’s phones, which tracks their location and travel routes, including if the person has been to a high-risk area.

China’s mask-wearing culture and other public health precautions, such as widespread temperature checking, have driven even higher levels of confidence in health and safety while travelling.

China has also rolled out QR code technology on people’s phones, which tracks their location and travel routes, including if the person has been to a high-risk area. It is compulsory in the sense that if people want to enter any government buildings, offices, malls or restaurants, it is a requirement to have a QR code scanned first before entering.

Each person’s QR code is unique and linked to their mobile number, which is linked to their ID card. With public cooperation it has been very effective in containing even small outbreaks.

‘Unlimited Travel’ Programs

A good old-fashioned airline price war erupted in China in the middle of 2020, pouring fuel on the fire of the pent-up travel demand. However, this is a price war with a difference. Firstly, it’s part of a government-led move to stimulate mobility to help drive economic recovery. The airlines are also competing with China’s vast high-speed rail network.

Meanwhile, two fast-growing consumer trends in China, online shopping and the rise of subscription-based products, are also at play in the travel recovery. Shopping site TaoBao is just one of several online shopping platforms offering express deliveries and increased convenience. There are others like, PDD, JD and The Little Red Book – with payment usually made through Alipay or WeChat Pay. There’s also been a big push from e-commerce websites for subscription-based services, such as JD which offers a membership programme.

On June 18, China Eastern introduced its “Fly at will” air ticket discount package, offering unlimited weekend flights until December 31, 2020. The passes can only be purchased through China Eastern’s app and the traveller must be a member of the airline’s frequent flyer programme.

The pass was priced at CNY3322 (USD480) but that promotion sold out and a new USD500 flight pass has been offered for travel up to June 30, 2021, offering weekday travel only. China Eastern’s innovation has since been copied by most airlines.

The unlimited travel passes have been credited with a huge surge in leisure and VFR travel across China. Destinations like Sanya in Hainan Island have experienced massive visitation. The passes are also designed to retain customer loyalty and feed engagement with the airlines’ growing frequent flyer programs.

Chinese Government Ownership of Airlines

There is explicit government support for China’s airline system, reflecting the widespread central and provincial government ownership of Chinese airlines. This support has helped to oil the wheels of the recovery.

China’s recovery is fragile – and susceptible to setbacks. We saw it in Beijing in June and traffic numbers to and from the capital were lower in the following months. But assuming authorities stay on top of things, and give people the confidence to travel, China’s recovery is expected to continue and be back into positive territory (relative to 2019) well before the end of 2020. By Chinese New Year in early 2021, Chinese aviation could be well into growth. The airlines have plenty of spare capacity remaining in their fleets and many more widebodies, formerly deployed on international routes, could be brought into domestic service.

China entered and is emerging from COVID-19 first. As a result, China is further along the pandemic pathway and is learning and adapting fast. For airlines and travel industries outside China looking on with envy, there are some building blocks that could be emulated to drive recovery amidst the pandemic, however it starts with effectively containing and suppressing the virus – that’s the cornerstone.