Ancillary Goes Online: Virtual Expo Business Transformation Panel

Share

In a panel at Virtual Expo, Cathay Pacific’s Aldric Chau and Auckland Airport’s Jayne Wear share how they are using e-commerce to tap into new revenue streams. This article originally appeared in Expo Daily Experience. Read the full issues and register for FTE APEX Virtual Expo — the platform will remain open as a resource until January 8.

In November 2019, Cathay Pacific launched a revamped Asia Miles e-commerce platform in an effort to create a frictionless experience for its customers. Now, while flight activity is diminished, the carrier is leveraging this platform to capture new ancillary revenue opportunities emerging from the COVID-19 crisis.

Despite the financial impact of the pandemic on airlines worldwide, Cathay Pacific’s head of Retail, e-Commerce & Travel Partnerships Aldric Chau, says that over the past 10 months the airline saw revenue for non-air retail items grow by 50 percent, with a focus on food & beverage: “We worked with Rosewood Hong Kong to curate our very special mooncake products,” says Chau. The gift-sets, designed exclusively for Marco Polo Club members, sold out in three days.

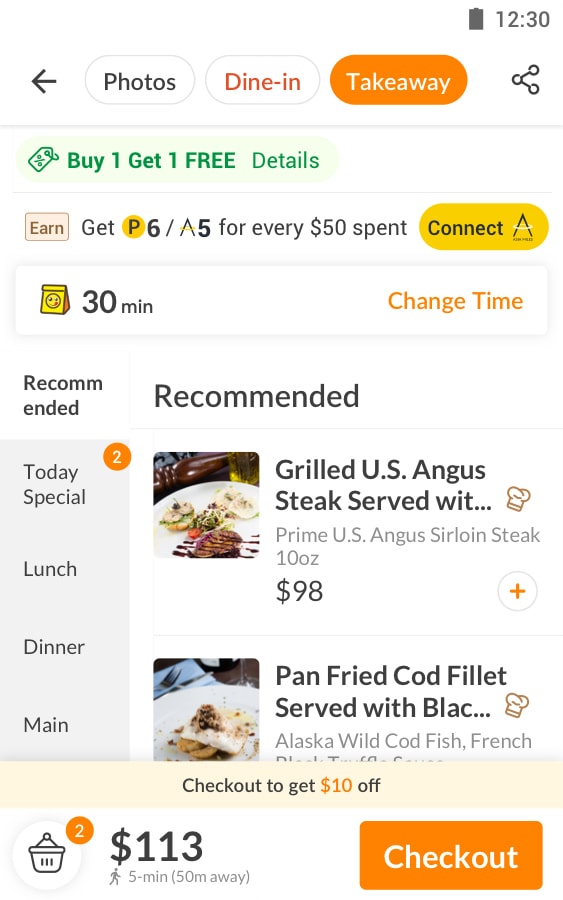

Other F&B revenue streams include delivering food boxes within the Hong Kong Airport area through a partnership with app-based food guide and restaurant booking platform OpenRice. “People can earn our frequent flyer currency when they’re booking restaurants or when they’re ordering takeaways and can’t dine out.”

Chau also pinpoints “food souvenirs” as a growing opportunity: “People living in Hong Kong who can’t travel still want snacks from Taiwan or Japan.” Cathay subsidiary Hong Kong Express recently started selling food hampers from Japan. The airline’s e-commerce platform also offers COVID-19 testing services, insurance products and a hotel selection tailored to quarantine requirements. “ [Digital has enabled Cathay] to join up all these touchpoints online and offline and present a consistent message

to customers.”

The Bucks Beyond the Building

Airports reeling from lockdowns and travel restrictions are also looking to pivot toward new revenue streams. In New Zealand, with international passenger volumes down 95 percent from 2019, Auckland Airport (AKL) saw the opportunity to extend its digital retail offering to its domestic terminal, as internal flights recovered by 65 percent.

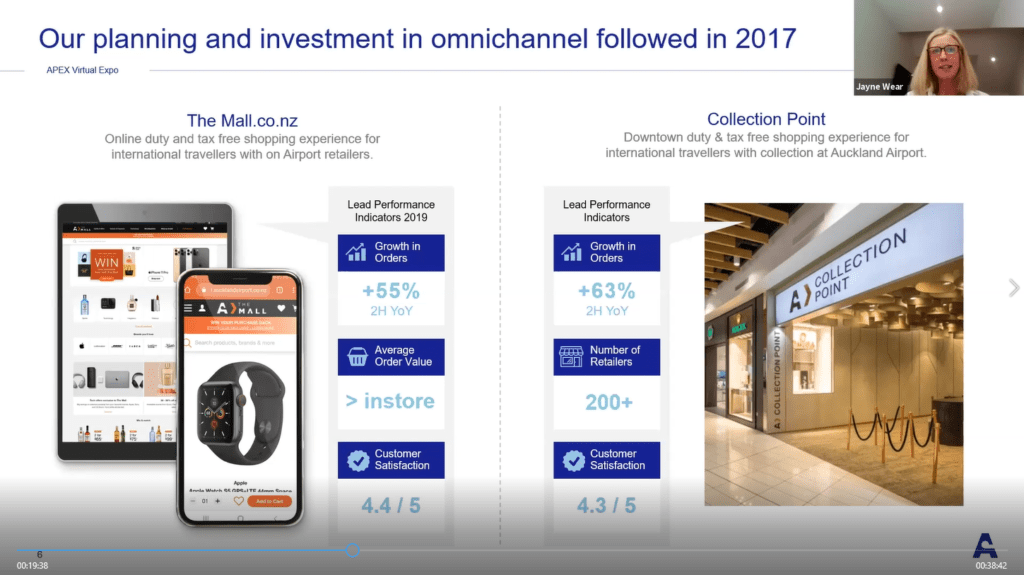

Prior to the pandemic, AKL was already focused on leveraging its digital rewards and recognition program, Strata Club, accessed via the airport app. Strata enables customers to earn and spend points when they book airport parking or shop across stores and restaurants within the terminals. Concurrently, the airport started the first phase of its omnichannel strategy partnering with AOE to design and build The Mall, an e-commerce marketplace providing travelers access to retailers and allowing them to pay at any stage of their journey using their mobile devices.

“International travelers who purchase duty- and tax-free goods from downtown stores need to be able to collect those as they depart Auckland Airport. We digitalized the service for off airport clients through a new logistics and fulfillment platform for the collection point,” says Jayne Wear, AKL’s head of Omnichannel, who notes that the airport’s retail offer had historically been restricted due to physical space constraints.

In June the airport surveyed domestic travelers on what would bring value to their airport journey. They responded by saying they wanted a contactless, international-type shopping experience when traveling domestically. “Travelers associate the experience of airport shopping with the excitement of upcoming travel and we wanted them to be able to continue to enjoy this, even though they’re not currently able to travel internationally.”

Six weeks after rollout, Wear says: “We’ve seen a similar degree of resonance to the core categories and brands shopped in our international experience. There’s been a greater volume of buying, given that the normal international travel allowance limit restrictions do not apply, as well as a higher mixed basket and average order values than we expected.”