IATA-Commissioned Study Explores Impact of Brexit on Aviation Industry and Passenger Experience

Share

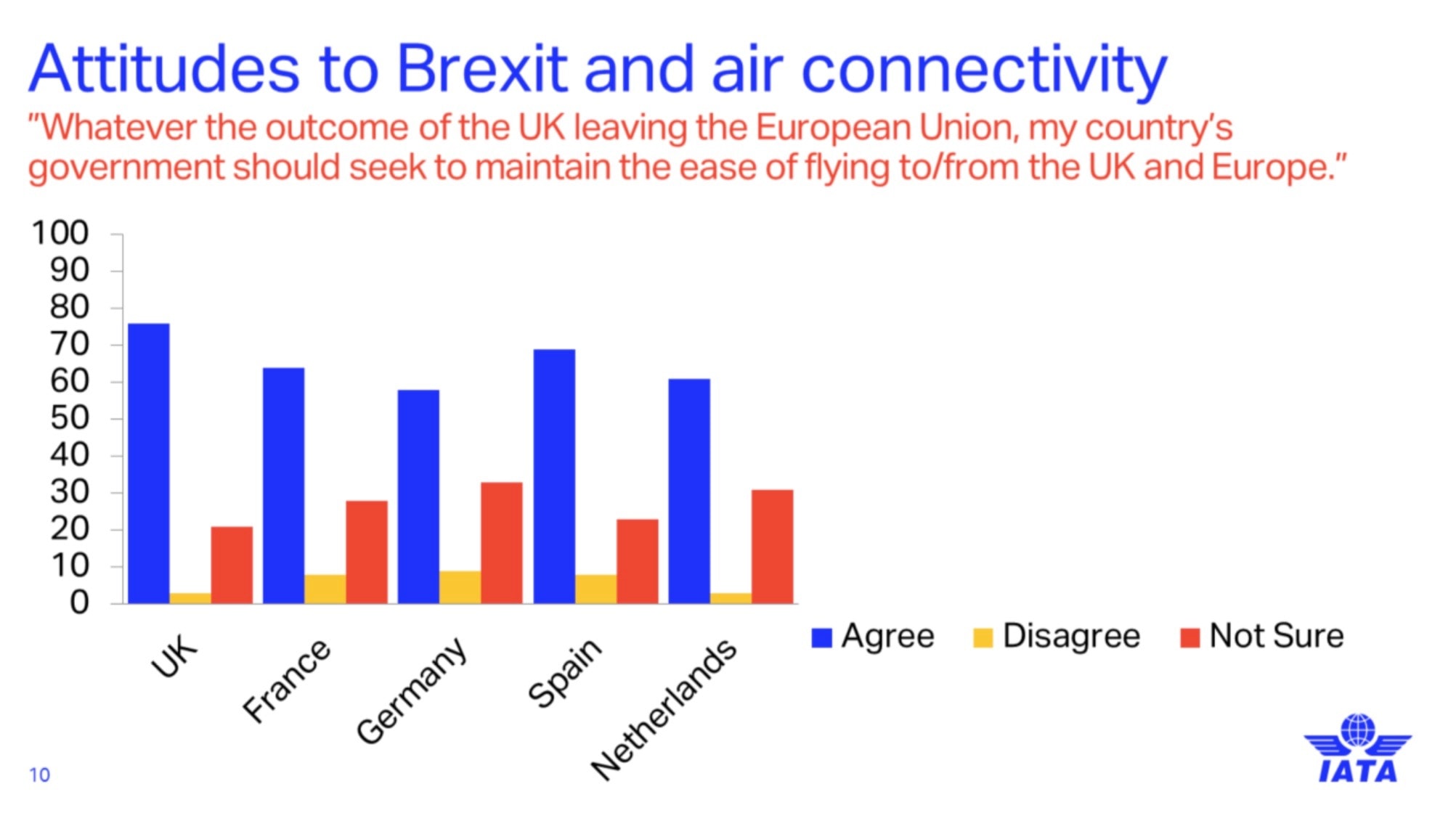

The lack of consensus on Brexit presents a challenge for airlines that wish to maintain a high standard of passenger experience for the 85 million people who travel by air between the EU and UK each year.

IATA commissioned a study on the potential impact of Brexit on the airline industry, conducted by the Taylor Airey consultancy.

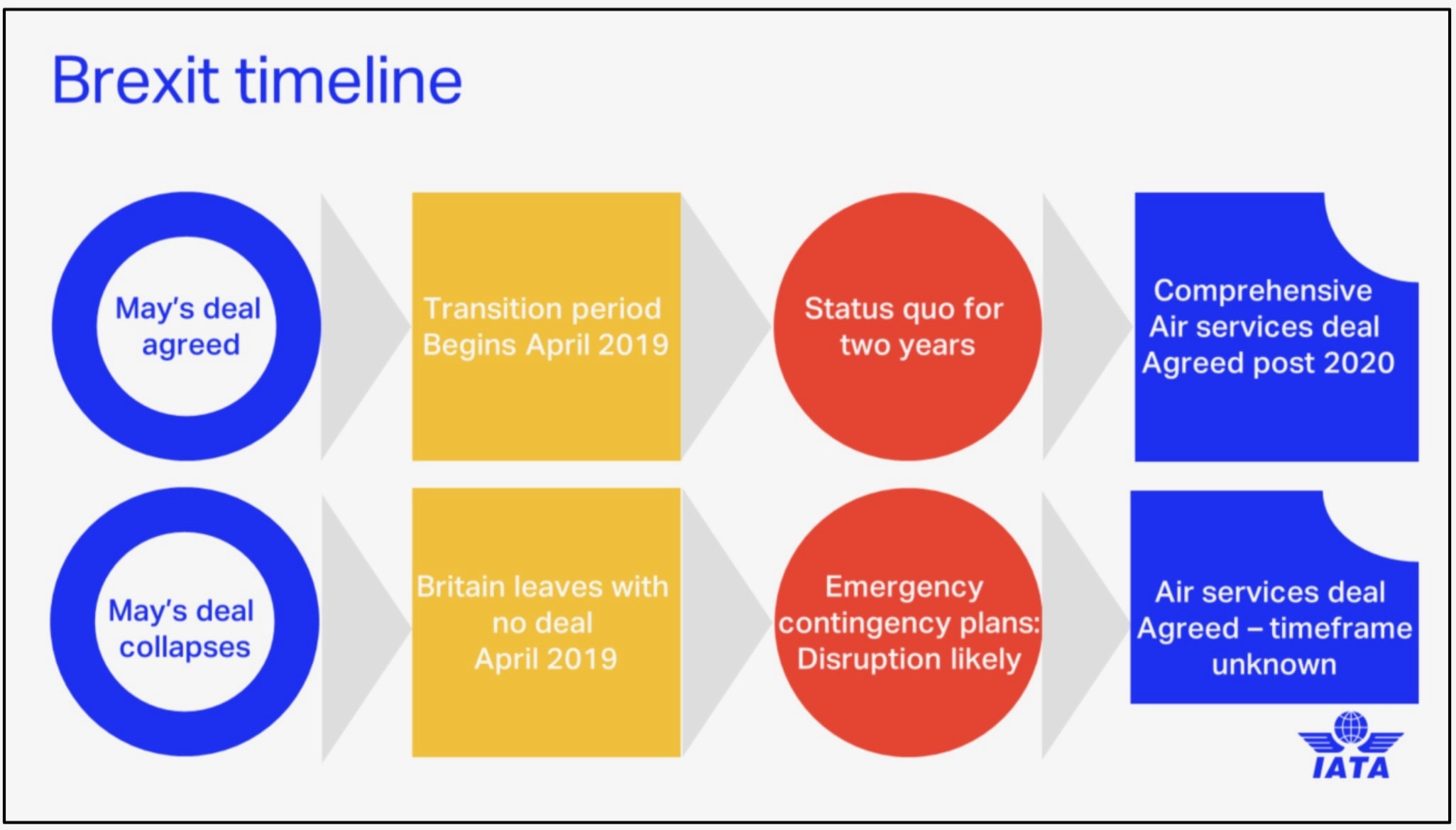

The report, which includes interviews with European and UK aviation industry stakeholders as part of its methodology, identifies four key issues that lack clarity: status of established air services agreements, safety regulatory framework, post-Brexit security processes and border management. These areas are particularly vulnerable in the case of a no-deal Brexit.

“In the case of ‘No Deal’ there will be no time to negotiate a comprehensive air services agreement between the EU and UK,” said Rafael Schvartzman, regional vice-president, Europe for IATA. “So a bare-bones agreement will need to be implemented to ensure at least a basic level of connectivity. The degree of regulatory convergence or mutual recognition of this basic level agreement is still unclear.”

There are no answers on how that regulatory rift would be mended and what would happen to ongoing approvals and audit processes for parts manufacturing and repairs. Other concerns include whether certificates issued by the European Aviation Safety Agency (EASA) to UK individuals and companies would still be valid; wether certificates issued by the UK Civil Aviation Authority (CAA) would be valid beyond the UK and whether aircraft operations from the UK would be considered third country operators and require a separate EASA certification. There is also no clarity on how aircraft registrations would be recognized for both owner/operator and EU-27 wet leasing operations.

“Our preferred solution would be for the UK to remain in EASA as a third country operator [others include the US, Canada and Singapore], but at a minimum, recognition of professional licenses, standards for materials and parts and other safety elements should be put in place to come into effect immediately after March. It is our understanding that a temporary arrangement is under discussion, but once again, we would like to see general transparency,” Schvartzman said.

RELATED: Aviation Industry Offers Mixed Response to UK PM’s Brexit Declaration

Eliminating free movement of people and goods raises concerns about the availability of parts to support day-to-day operations, which could impact production lines of new aircraft, and parts needed for maintenance. “Disruption to freight movement looks inevitable, but could be limited to a negligible amount if administrative delays and regulatory divergence are kept to a minimum,” Schvartzman said.

In terms of security, with a ‘No Deal’ scenario, passengers and baggage may have to undergo separate screening on flights between the EU and UK, but this could be avoided if the UK receives third country recognition.

“There are clear precedents for the EU to recognize the UK’s security procedures despite the UK no longer being an EU member state. Such recognition would not require adjustment to UK aviation security standards because of today’s current compliance,” Schvartzman said. “There are also clear incentives for the EU to add the UK to the list as extra screening would be detrimental to the entire European aviation industry, not just the UK.”

Whatever border processes are adopted post Brexit will impact the 85 million passengers that travel between the UK and the EU every year. A continuation of the policy of visa-free travel and the use of e-gates at border controls could help avoid delays.

“We don’t have any special insight on how this will play out,” said Alexandre de Juniac, Director General and CEO of IATA. “But we do know that the industry needs more clarity than we currently have.”