Opportunity for In-Flight Advertising as Third-Party Cookies Are Phased Out, Inadvia Says

Share

An advertising industry survey carried out by Inadvia found that while 76% of respondents saw in-flight travelers as a desirable audience, only 26% had invested in an in-flight campaign. It revealed a clear desire for in-flight advertising to be more targeted and for the process of buying ads to be more seamless. According to Inadvia’s Tim Letheren, as Internet browsers begin phasing out third-party cookies, in-flight media will become an increasingly enticing option for advertisers since airlines collect and own passenger data.

Inadvia has released the results of its Attitudes to Inflight Media Survey 2020 (AIMS 2020), which was conducted during January and February to investigate how the airline industry can best tackle the challenges of monetizing their in-flight entertainment and inflight connectivity (IFEC) products.

The company surveyed 65 advertising stakeholders and budget decision makers across brands, media agencies and technology vendors, and found that while in-flight travelers were identified as a desirable audience by 76% of respondents, only 26% had invested in an in-flight campaign.

When asked about on the strengths of in-flight advertising, over 95% of respondents agreed that the medium provides genuine audiences, high view rates and passengers with an engaged mindset. The least popular responses were that it provides unique targeting and that buying in-flight ads is compatible with industry workflows and standards.

“Publishers who collect and own their own data will be in an incredibly strong position and become far more enticing partners for advertisers going forward.” – Tim Letheren, Inadvia

Based on responses about the weaknesses of in-flight advertising, Inadvia came up with five main issues: targeting, reporting, scale, trading and user experience. 89% of respondents replied “Yes” to the question, “Would you be interested in in-flight video advertising if it was more addressable?” They then went onto identify age/demographic, route/destination and language as the three most important criteria for targeting. Least popular was the importance of targeting passengers by airline.

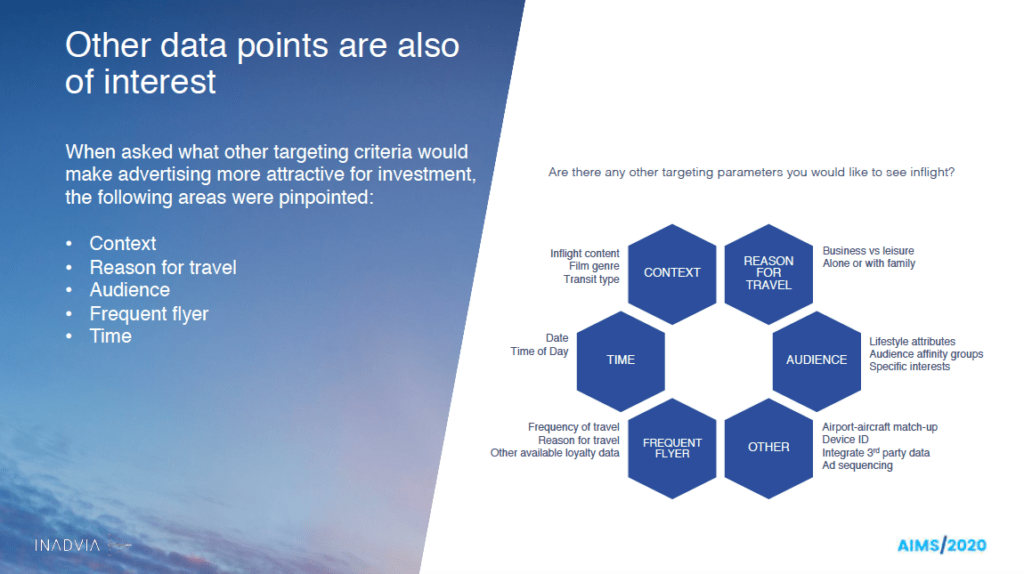

When participants were asked what additional targeting criteria would make in-flight advertising more attractive, Inadvia received a range of responses, including the ability to target passengers by the date they were flying and time of their flight, the content they were consuming on an airline’s IFEC system and their reason for travel (business or leisure).

While targeted, personalized advertising is crucial to allow advertisers to reach their desired audience efficiently and effectively, respondents acknowledged the way it is done is now changing – 98% agreed that first-party data will become increasingly important as third party cookies are phased out.

“Third-party cookies are cookies created by domains rather than the one you are visiting directly, and are used for cross-site tracking, retargeting and ad-serving,” explained Tim Letheren, co-founder and director, Inadvia. “For years, they have been fundamental to the way advertising has been targeted online, but in recent years there have been increasing questions around user privacy and data, especially with new regulations such as GDPR in Europe. It was unsurprising for many that this year Google followed Safari and Firefox in announcing its intention to phase out the third-party cookies by 2022.”

“This means publishers who collect and own their own data (first-party data) will be in an incredibly strong position and become far more enticing partners for advertisers going forward, as they search for fully transparent and compliant ways to reach their target audiences,” Letheren continued. “In our case, those publishers are airlines and IFECs and if this is embraced properly, there is a huge opportunity to attract significantly more advertising investment into the sector.”

In terms of which ad formats are most attractive, pre-roll video was the clear winner, with 100% of respondents selecting this answer, while branded content came a close second with just under 90%. Sponsored Wi-Fi was the least popular answer, with 65% of respondents saying they were interested in this option.

Inadvia’s survey showed there was a clear demand for in-flight advertising to be traded programmatically. 59% of participants said they would be more likely to invest in in-flight media if it was traded solely using programmatic, followed by 39% if it was traded using a combination of programmatic and insertion orders (direct, manually sold campaign) versus only 2% being more interested if in-flight media was traded using insertion orders only. 96% said they would consider buying in-flight ads programmatically in the future; and 95% said they would be more likely to invest if they could access inventory across multiple airlines from one platform.

While the survey was conducted before the effects of the coronavirus pandemic on the airline industry became apparent, Letheren believes that programmatic advertising will maintain its growth in importance in a post-COVID world. One reason for this is a potential move away from traditional printed in-flight media moving forward.

“If the physical inflight magazine does disappear, there will be two losses to the airline – a loss of passenger engagement and a loss in immediate print advertising revenue. However, I think that magazine content can and should live on in platforms passengers are able to access via their own devices,” he explained. “If that is the case, then the way to monetise that advertising inventory would have to be via a digital marketplace rather than traditional print buying – it is just another important reason why airlines and their IFEC partners should focus on their digital in-flight advertising strategy as a priority.”