Spotlight on the Middle East: Beyond the Heated Competition for Luxury

Share

The Middle East is hot aviation territory, and not just because of its abundant sunshine.

Both Airbus and Boeing predict strong growth in the region.

“Middle East carriers had the strongest traffic growth at 11.7 percent. Capacity rose 13.9 percent and load factor fell 1.4 percentage points to 70.1 percent.”€”IATA November 2014, Passenger Figures, published 8 January 2015

The Middle East also capitalizes on its strategic position for growth in freight services.

“Middle Eastern carriers [had] strong performance, with FTK growth of 12.9 percent and a 17.1 percent increase in capacity.”€”IATA November 2014, Freight Figures, published 7 January 2015.

Large investments in new airplanes and lavish airport cities capture our imagination. Etihad wooed the world with its new The Residence apartment on the A380 and many introductions that followed with its Reimagined branding campaign.

Dubai, as the home-base of the region’s leading carrier, Emirates, has risen to surpass Heathrow Airport as the world’s leading air travel hub. But Abu-Dhabi and Qatar aim to take their share with their own luxurious airport experiences, including the introduction of the new TOSA spa at Abu Dhabi International Airport this December, and Qatar’s substantial investment in its new Hamad International Airport. Qatar Airways hopes its new high-capacity long-haul aircraft, the A380 and A350XWB, will drive more passenger traffic through Doha.

“The region’s central hubs allow carriers to serve hundreds of routes that have insufficient traffic to warrant point-to-point service.”€”Boeing Current Market Outlook 2014-2033

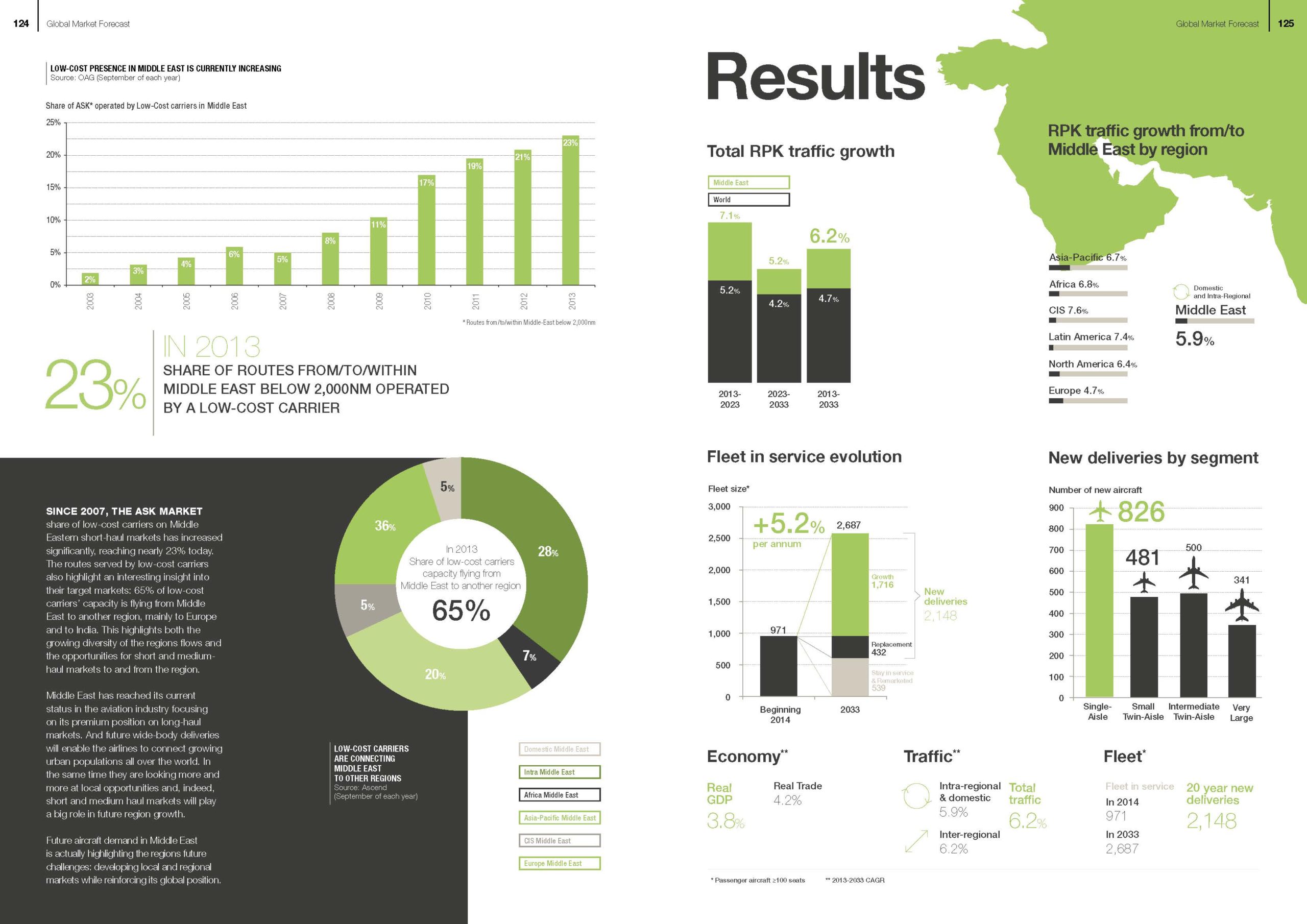

There are also hot happenings in the Low-Cost Carrier (LCC) sector.

The APEX Middle East Conference this March 24-25, Abu Dhabi, will examine the progress of these initiatives, and take a closer look at all that glitters in the region.