APEX TECH May 2019: Takeaways From Day One

Share

On the first day of APEX TECH, the APEX Airline Advertising and Ancillary Revenue Committee announced the creation of a new glossary of terms, which has been approved by advertising multinational WPP and global airlines. Airline executives from Avianca, Air China and LATAM discussed digital transformation and the importance of operational performance and passenger feedback. Other topics addressed during the day included IATA’s NDC and using data to drive IFE content selection and ancillary revenue.

To read the takeaways from day two of APEX TECH May 2019, click here.

Avianca Details its Ongoing Digital Transformation

Avianca Airlines is in the midst of an evolution “to transform into a digital company that flies airplanes,” said Rolando Damas, general director North America & Asia, Avianca Airlines.

2019 marks Avianca’s 100th anniversary, making the Latin-America carrier the second oldest airline in the world. “But we were lacking one thing, which was technology. Two years ago, we started a digital transformation to provide a customer experience to bring us up to date,” he added. With the objective to exponentially transform the customer journey and experience, “our customer must be at the center of everything we do,” said Damas.

Air China is Prioritizing Operational Performance Over Ancillary Revenue

“When you get your experience right, the money will follow,” said Dr. Zhihang Chi, VP and general manager, North America at Air China. He expressed doubt about whether personalization will be that effective because “most passengers are price sensitive and don’t fly that often.” Instead, Chi said, “We need to get the basics right and look for opportunities that are simple to implement and provide benefits to lots of passengers.”

Chi also said the industry has focused too much on increasing ancillary revenue. “We are not talking too much about operational performance, where I think there is a much bigger bang for the buck.”

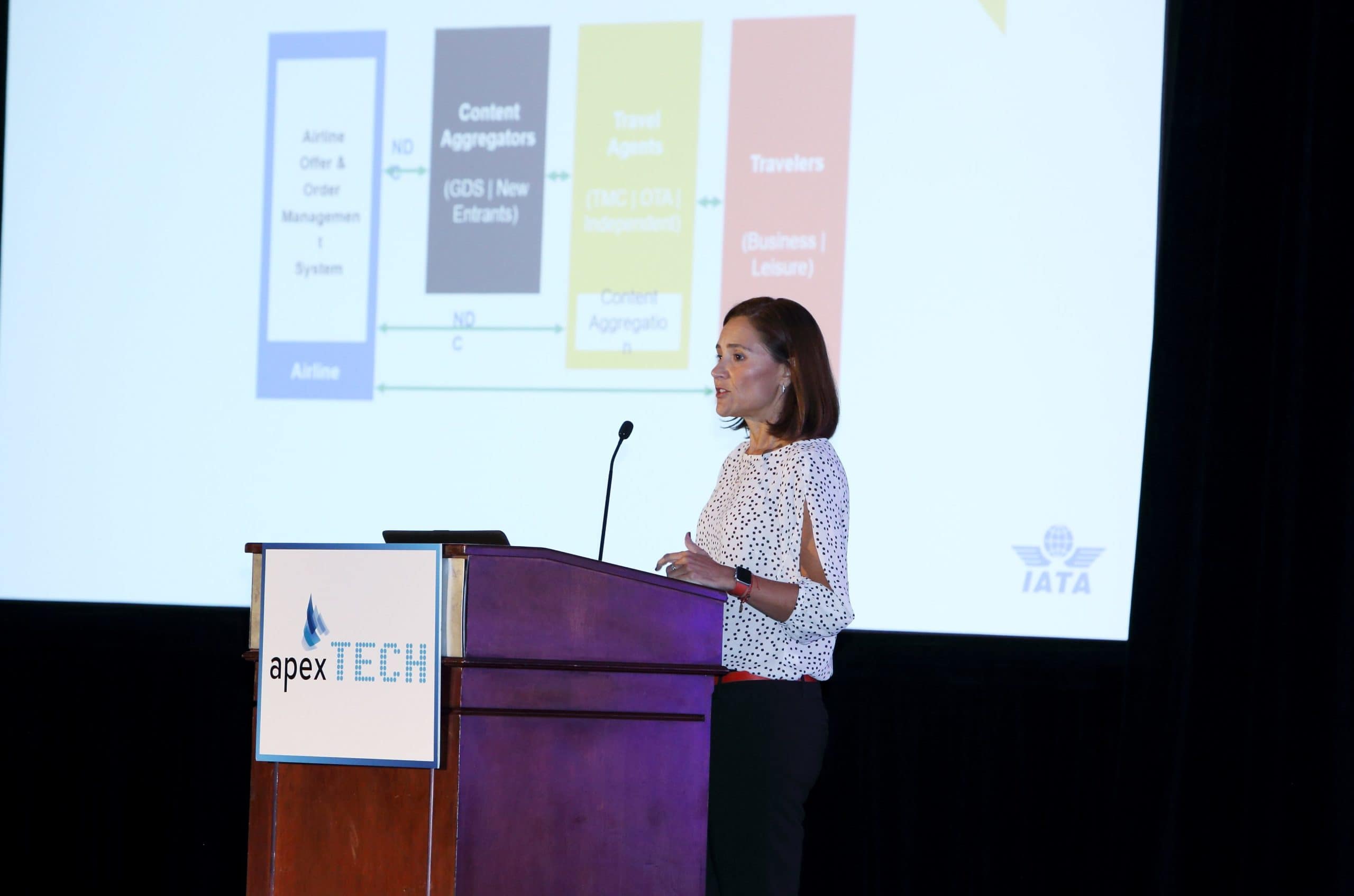

IATA Shifts NDC Focus Away From Airlines

For the past five years, the International Air Transport Association (IATA) has been promoting the implementation of NDC – or New Distribution Capabilities. NDC is a travel-industry supported program for the development and market adoption of a new data transmission standard, which promises to provide all distribution channels with similarly full and rich content, enhancing the passenger’s travel booking experience.

Now, with 67 airlines on board, IATA has made a shift in the program’s objective, according to Alicia Lines, IATA’s regional director, Financial and Distribution Services, the Americas: “We are no longer pursuing airlines. Airlines know they need to be NDC-certified if they want to compete in the world,” she said.

FlightPath3D Says Big Data Helps Drive Airlines’ Ancillary Revenue

“Big data is a cultural movement that helps us understand how humanity interacts with the world,” said Duncan Jackson, president, FlightPath3D. “For our industry, big data is helping the airline industry understand how passengers interact with the travel experience.”

With 90% of the world’s data having been created in the past two years, Jackson outlined the three data trends his company’s research has identified: Big data is driving the growth in experiential travel; the combination of big data and artificial intelligence is driving personalization; and big data is key to the growth in ancillary revenue. As an example, he explained how FlightPath3D leveraged billions of online data sets to generate crowd-sourced destination content that enhances the company’s immersive in-flight map technologies. “Making data-driven recommendations helps the passenger feel understood.”

The Role of Data Analytics in Content Selection and Delivery

The number one job of a content service provider is to curate content, because these days it is not enough to put a movie such as Avengers: Endgame on board, explained André Valera, business development director, Touch Inflight Solutions. “That is why analytics is important.”

Analyzing the insights from an airline’s in-flight entertainment viewership data, Touch Inflight can perform predictive analysis to maximize existing content. “We deliver tangible knowledge about an airline’s passengers,” he said. Touch Inflight is also able drill down and evaluate the performance of in-flight content based on seats, cabin class, and even demographic. “By having this information, airlines can make better decisions about where to invest.”

Moving forward, Valera said the biggest challenges include standardizing data across multiple IFE hardware platforms and having the entire ecosystem speaking the same language.

LATAM Incorporates Passenger Feedback into PaxEx Improvements

“Passenger needs are changing very, very fast,” said Juan F. Ordoñez, VP of Onboard Service for LATAM, which won five Passenger Choice Awards at the event. “Maybe three years ago, when we looked at ourselves, we realized we were lagging dangerously behind.”

The airline’s research showed that passengers wanted two things: more options for flights and the flexibility to customize the travel experience. “We needed to act, and act very quickly,” said Ordoñez.

To meet its passengers’ needs, LATAM focused on four areas. It created a flexible fare structure; revamped its digital services and infrastructure; revolutionized in-flight catering; and transformed its cabins. And in order to obtain immediate feedback from customers, LATAM implemented a simple tool that asks for passenger comments upon a flight’s arrival. “Even if you’re not satisfied, you’re engaged,” said Ordoñez.

APEX Airline Advertising and Ancillary Revenue Committee (ARC) Update

The APEX Airline Advertising and Ancillary Revenue Committee (ARC) provided updates on its progress. The committee was set up to increase awareness and monetization of the airline passenger experience through advertising.

Kimberly Creaven, VP of Global Advertising, Sponsorships and Advertising at Global Eagle and chair of ARC, announced the creation of a new glossary of terms, which has been approved by advertising multinational WPP and global airlines. “One of the reasons we wanted to do this is because CSPs, advertising agencies and airlines have different terminology,” explained Mary Rae Esposito, media sales director, US at Spafax and ARC member.

While global advertising is now a $600 billion industry, in-flight entertainment advertising has the potential to double from its current $200 million, according to Creaven.