APEX/IFSA Release COVID-19 Airline Customer Sentiment Report Conducted by FETHR

Share

Face-to-face conversations between frontline airline staff and passengers may be at an all-time low as the commercial aviation industry contends with the seismic shifts brought on by the coronavirus pandemic, but customers are still being vocal about what they want. Airlines just need to listen.

The Airline Passenger Experience Association (APEX) and the International Flight Services Association (IFSA) have enlisted Black Swan Data’s aviation arm, FETHR, to provide insights based on COVID-19-related passenger discourse on social media. The result is the APEX/IFSA COVID-19 Airline Customer Sentiment Report, exclusive to both associations’ members, which analyzes data from more than 900 million naturally occurring social media conversations in the last two months, providing tactical recommendations for the near- to mid-term.

APEX members can click here to sign in and download the

APEX/IFSA COVID-19 Airline Customer Sentiment Report.

IFSA members can click here to sign in and download the

APEX/IFSA COVID-19 Airline Customer Sentiment Report.

According to the report, passenger confidence has eroded in the wake of the pandemic, with over 8.5 million social conversations conveying a negative outlook – up 43 percent in past two months. “Right now passengers are very frustrated, and as a result, they are responding to airline surveys very negatively. The benefit of our methodology – of looking at what’s naturally occurring across different social channels – is that we can pick up what’s truly important. It might even be something airlines haven’t thought to ask about,” says Will Cooper, insights director at FETHR.

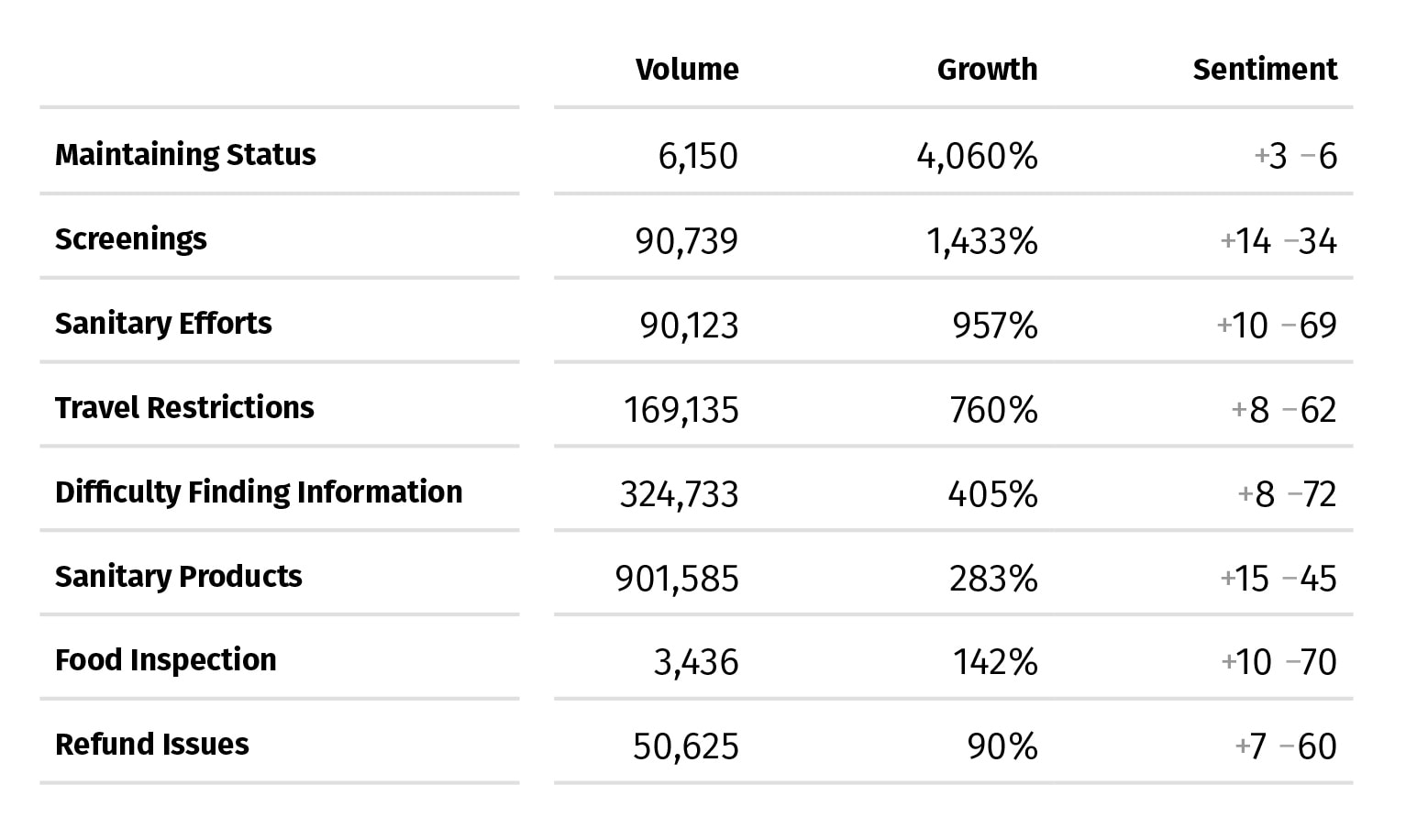

The conversation themes that experienced the highest growth in the past two months include maintaining loyalty status (4,060%), screenings (1,433%) and sanitary efforts (957%). However, according to Cooper, sentiment is the key metric airlines need to zero in on to identify problem areas: The conversation themes eliciting the most negative passenger sentiment in order are 1) difficulty finding COVID-19 information, 2) food inspection and 3) sanitary efforts.

APEX/IFSA CEO Dr. Joe Leader says food inspection surfacing as a top concern among airline passengers was unexpected, and led APEX to involve IFSA. “It was a surprise that affects every IFSA member supplier offering in-flight food and beverage,” he says. “IFSA caterers need to embrace food sanitation priorities and clearly communicate them via airlines. For example, labeling that meals have gone through a final UVC light or external plastic FDA (or equivalent)-approved spray would be the highest return on investment imaginable to caterers.”

Key to clamping down on much of the negative sentiment seems to be communication – a passenger conversation topic that garnered over 8 million hits. This is especially true when it comes to highlighting sanitary efforts, Dr. Leader says: “This is the time that airlines should be integrating that information into their booking engines and apps. Passengers do not realize that the aircraft itself is one of the safest places on the journey.”

The conversation themes eliciting the most negative passenger sentiment in order are 1) difficulty finding COVID-19 information, 2) food inspection and 3) sanitary efforts.

The study goes on to compare the performance of 100 airlines in their response to the coronavirus pandemic, resulting in a top 10 list led by Singapore Airlines, which consistently performed above average across positive driver categories. Singapore Airlines holds a performance score of 30 – that’s 12 points above the average. In certain categories, such as proactive measure and community spirit, Singapore Airlines was surpassed by Qatar Airways and KLM, respectively.

“KLM is an interesting example,” Cooper says. “Initially it hadn’t performed as well in the area of communication, in particular when it came to customer service channels where they were quite overwhelmed. But one of the things we saw in response was passengers relying on each other and a community emerging, with frequent flyers advocating for the brand and making recommendations based on their own experiences.”

“We in the air travel industry should look to become one of the safest places that people can firmly rely upon during an uncertain time.” €” Dr. Joe Leader, APEX/IFSA CEO

FETHR’s social listening technology can be applied to virtually any area of an airline’s business, but right now COVID-19 is taking precedence. The company is providing granular assessments to individual airline clients, showing how their response to the pandemic benchmarks against the categories and competitors that matter most to them. “In some of the more recent conversations we’ve had with our airline partners, we see they’re thinking much more about what they should be doing and what the future looks like,” Cooper says. “We see that coming through with airlines announcing sanitary initiatives like social distancing on board and providing protective equipment, as well as screening.” These efforts coincide with areas identified in the report as having yielded the highest percentage of positive sentiment among airline passengers over the last two months.

Speaking of the origins of the study, Dr. Leader says, “Black Swan Data’s FETHR has been working with APEX on a next-generation way to provide airlines data cross-referenced with the 2021 APEX Official Airline Ratings. But in light of the COVID-19 crisis, FETHR shifted gears to better serve APEX airlines and members by listening to COVID-19 passenger feedback via social media.”

Looking to the future, Dr. Leader cautions against thinking of the coronavirus pandemic as one would any previous airline crisis. “This one requires a mindset change in all of us. In the next couple of months, a new world will begin to emerge,” he says. “We in the air travel industry should look to become one of the safest places that people can firmly rely upon during an uncertain time.”