Premium economy was once a differentiator. Now that so many airlines offer it, does it still deliver a competitive advantage?

There’s no shortage of anecdotes about how financially challenging air transport is. “Razor-thin margins” is a common description, with IATA even once bemoaning passenger profits being less than the price of a sandwich. So, it is intriguing to hear Lufthansa Group’s head of Commercial Passenger Airlines Harry Hohmeister during the airline’s 2019 Capital Markets Day presentation refer to any facet of the business as a “money-generating machine.” And yet he did.

The machine in question is a class of service, specifically premium economy. And apparently it is drawing 33 percent more revenue per square foot than the traditional economy-class offering, and six percent more than business class for the airline. American Airlines president Robert Isom draws a similar conclusion, saying on a 2019 earnings call that its premium economy offering – with fares twice that of regular economy – is “the most profitable use of square footage on our wide-body aircraft.” Meanwhile, Singapore Airlines’ A350-900ULR does not even have economy, offering only business and premium economy.

So, the premium economy secret is well and truly out. What was once a niche offering by EVA Air and Virgin Atlantic in the 1990s has grown, so much so that it might be easier to identify which airlines do not have it. Does premium economy still offer a competitive advantage, or has it become an expected class? Can it somehow retain its leader status?

So, the premium economy secret is well and truly out. What was once a niche offering by EVA Air and Virgin Atlantic in the 1990s has grown, so much so that it might be easier to identify which airlines do not have it. Does premium economy still offer a competitive advantage, or has it become an expected class? Can it somehow retain its leader status?

Certain airlines looking to speed up the money machine have been allotting more room for premium economy on new aircraft or retrofitting their fleet. Qantas, for instance, is reconfiguring its Airbus A380s, upping its premium economy cabin from 35 to 60 seats. That count is similar to the 56 premium economy seats British Airways and Virgin Atlantic both have on their new A350-1000 aircraft, even though the type is smaller than the A380. Premium economy comprises 17 percent of all seats on Virgin’s A350, compared to 13 percent on its 787.

Gains in cabin real estate for premium economy seats almost always come at the expense of economy seats – not those in business class. When premium economy gained momentum in the last decade, airlines had fresh memories of the global financial crisis that dented premium cabin travel. Having recovered the traffic, airlines were initially reluctant to make a reconfiguration that might further weaken premium revenues – a worry that has resurfaced more recently for Lufthansa.

“You have to understand [whether it is] an upgrading segment or a downgrading segment. We very much had the fear at the very beginning that it would be a downgrading segment, [but] this whole thing was an upgrading story,” Hohmeister said. The group expanded premium economy to subsidiary Austrian Airlines in 2018, and next year Swiss International Air Lines’ A340s and 777s will receive a premium economy cabin too. Meanwhile, United Airlines has recently rolled out premium economy, and already sees a four to six percent improvement in overall revenue per available seat mile on flights with the class offering, CCO Andrew Nocella shared on an earnings call last July.

“For Lufthansa, Premium economy draws 33% more revenue per sq ft than economy, and 6% more than business.” – Harry Hohmeister, Lufthansa Group

PICKING SIDES

Premium economy is a loyalty pull – especially among business travelers, whether they are on the job or not. Reports of wholesale corporate travel policies downgrading from business to premium economy are uncommon, but an airline introducing premium economy in a home market that didn’t have it could see increased revenue from travelers whose corporate policy permitted the class but didn’t already have access to it.

Meanwhile, travelers who’ve grown used to plusher business-class cabins but are unable to afford it on their own dime may find premium economy a happy medium. “Some people aren’t happy with only economy,” says Katsunori Maki, manager, Products and Services Strategy, All Nippon Airways (ANA). The airline offers 24 premium economy seats on its 777s, but its A380, almost exclusively used to serve the airline’s leisure Japan-Hawaii market, will feature over three times the amount.

Cannibalization concerns can also apply downward for an airline like Korean Air, which does not have premium economy. Korean reckons it has established loyalty from a more generous economy class, where pitch is upward of 34 inches and its 777s are still nine-abreast instead of 10. In this case, properly segmenting for premium economy would require scaling down the current economy offering, something a Korean Air spokesperson says it does not plan to do anytime soon.

Korean Air may be the largest transpacific operator without premium economy, but approximately a third of its passenger revenue is tied to transpacific flights as part of a joint venture with Delta Air Lines, which offers the class of service. Delta says it has found loyalty through premium economy and higher cabin classes, with 70 percent of those experiencing higher-class products on board going on to buy a product of equal or higher value on future travel. The growth of joint ventures and metal-neutral operations may be what it takes for carriers to align their passenger propositions.

Another large airline without premium economy is Qatar Airways, which, like Korean Air, is proud of its existing economy class. “Passengers will feel more comfortable sitting in the Qatar Airways economy cabin than in a premium economy cabin with another airline,” CEO Akbar Al Baker told Blue Swan Daily last year.

In Qatar’s backyard is Emirates, which plans to debut premium economy this December on an A380 – news with significance that extends beyond competition with Qatar Airways. Airlines with sizeable home markets have the benefit of loyalty from locals, who may be easier to educate about a new product. Emirates’ home market of Dubai is small, at about three million, but it can piggyback on international passengers from larger markets, such as the UK, Australia and the US, who are familiar with premium economy since their local airlines offer it. Emirates is already in the second-largest long-haul premium market: between Europe and Asia.

For many airlines, premium economy and higher cabin classes have been a way to reduce exposure to competition from new or growing airlines on transatlantic routes. “Premium product margins have improved three times more than the margin improvement we’ve seen in the main cabin,” Delta senior vice-president Pricing and Revenue Management Eric Phillips said on a 2019 earnings call. On a larger scale, IATA calculates that while average yields have weakened since 2014, premium yields have been consistently better than those from economy.

The largest premium market remains transatlantic, where many flights stretch to 11 hours. While travelers on transatlantic routes may be more inclined to travel more luxuriously, the Asia-Pacific region is seeing an increasing demand for premium economy on flights over eight hours, such as those from Sydney to Hong Kong and Singapore. Yet not every Singapore Airlines flight to Australia has premium economy, and in 2015, Cathay Pacific took premium economy off flights to India. The only other major wind-back of premium economy comes from Turkish Airlines, which removed it, having initially offered the cabin only on 777s.

WHERE TO FROM HERE?

Overall, premium economy’s outlook is one of expansion and refinement, with airlines delving more and more into soft services as a point of differentiation. This largely owes to the fact that passenger reviews about the physical seat do not vary as much as they do for first and business class, where design options are greater. Yet there are innovative proposals in the pipeline, such as New Territory’s Interspace seat, which has wings hinged to the seatback that fold out to form a privacy divider that passengers can lean on.

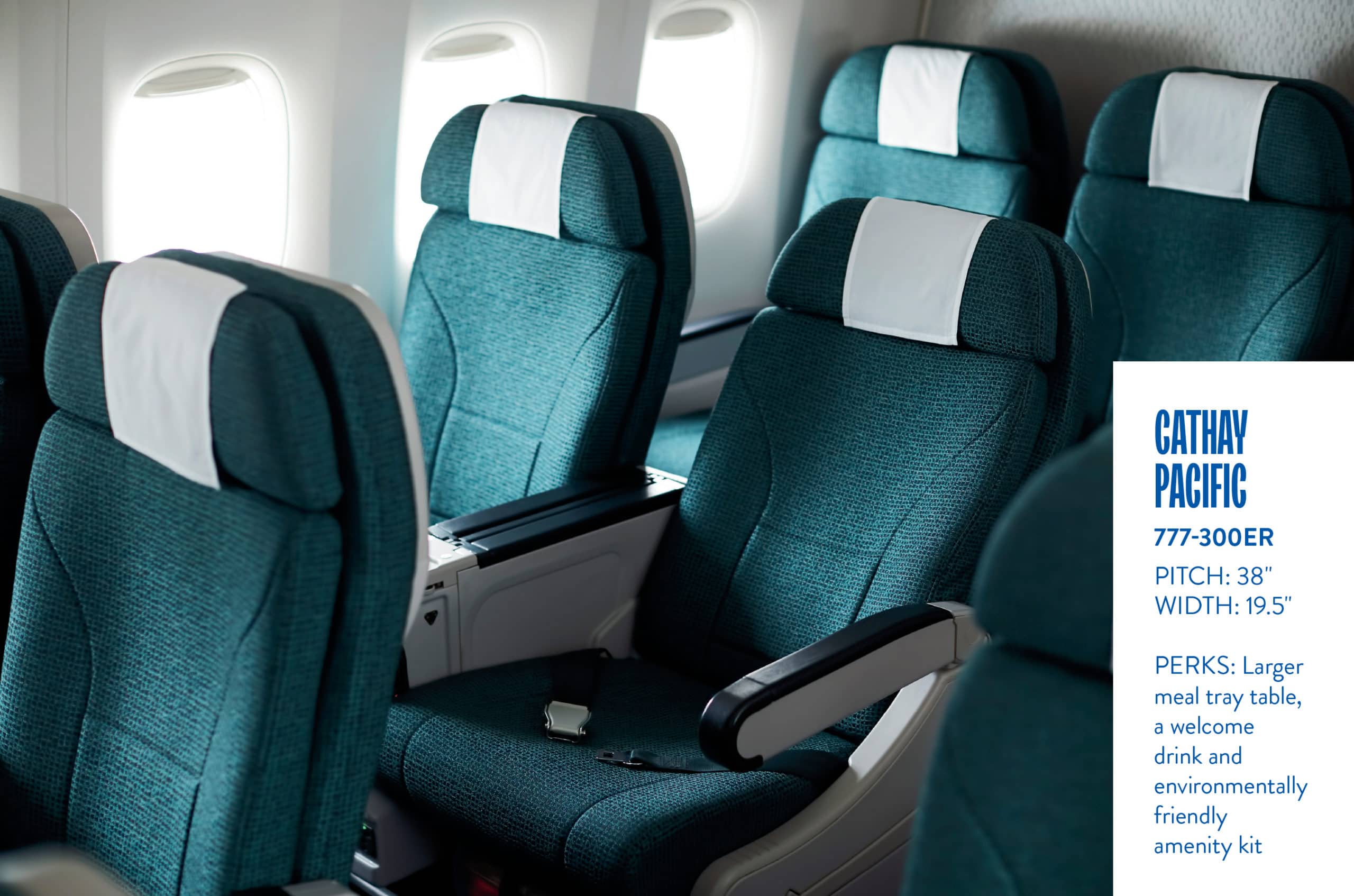

Mood lighting, catering options and ground services are being used to round out the offering. Philippine Airlines worked with Tokyo-based brand and design consultancy LIFT Aero Design to introduce its first premium economy cabin and pair it with mood lighting, while ANA also created special mood-lighting presets for individual cabins on its A380. Qantas offers sparkling wine as a pre-departure drink, while Singapore Airlines has extended its Book the Cook preorder meal service to premium economy. Cathay Pacific plans to relaunch its premium economy catering this year, following in the steps of British Airways, which last year overhauled premium economy food as well as amenities. And lastly, some airlines are finding points of differentiation on the ground, such as priority check-in and lounge access.

While Lufthansa’s Hohmeister extols premium economy’s revenue-to-space ratio, he says less quantifiable elements are just as important: “The reality is the service process has to go in line, otherwise in terms of profitability, this will not work.”

“Upacking the Perks of Premium Economy” was originally published in the 10.2 April/May issue of APEX Experience magazine.